The municipal budget is a document describing the income and expenses of the municipality. It is a financial accounting document that explains the services offered by the municipality and how much they cost to deliver. Looking at a budget can give you a glimpse into the health of a municipality and its operations.

The Mt. Lebanon Charter specifies that the fiscal year for the municipality runs the first day of January through the last day of December every year. On the first day of November, the municipal manager submits a proposed budget to the commission for their review and approval.

The budget is not approved right away – it goes through several weeks of review, discussion, questions, and modifications by the commission.

The current and next year’s recommended budget can both be found toward the bottom of the finance department web page at the municipal website.

Balanced Budget Requirement

The charter requires that the total proposed expenditures shall not exceed the total estimated income. Essentially, this means that the municipality must balance the budget (or show a surplus) before it can be approved.

Typically, when expenses are projected to exceed income, the manager has a few choices before submitting the recommended budget to the commission. The manager can recommend cutting costs or entire programs or services so that the expenses fall in line with current revenue, or the manager can recommend raising taxes so that revenue meets or exceeds the level of expenses.

The commission is not actually required to adopt the manager’s recommended budget. If this happens, the current approved budget in place for the current year will continue on a month to month basis until such time as the commission approves the recommended or amended budget.

Approving the Budget

After holding at least one public hearing on the budget, and giving members of the public the ability to provide public comment, the commission may approve the recommended budget or the budget with amendments. Again, the commission may only approve a budget which has been balanced or where the income exceeds expenses.

Taxes

Prior commissions have raised taxes and they have lowered taxes. The need to do either depends on the situation and typically happens in response to a specific need. Currently, the municipal tax rate is 4.91 mills.

How Taxes Work

Here’s a quick summary of how municipal taxes work.

Property tax rates are usually expressed in millage rates or mills. A millage rate is the amount of tax you pay per $1,000 of home value. Mills are expressed as tenths of a penny ($0.001), and one mill equals $1 in tax for every $1,000 of home value.

Take the current tax level of 4.91 mills. This equates to $4.91 dollars of tax per $1,000 dollars of assessed value of your taxable property. That means if your property were assessed by the county at $1,000, you would owe $4.91 in taxes to the municipality.

Remember, there are other taxes included in your annual tax bill. This typically includes school tax and county tax. The municipal portion of the tax is typically the lower of those tax items.

The median home value in Mt Lebanon is $268,000. Here’s how you can figure out the municipal tax portion of taxes on a property assessed at $268,000.

- Divide the assessed value by 1,000

- $268,000 divided by 1,000 = 268.

- Multiply that number by the mill rate.

- 268 multiplied by the mill rate of 4.91 = $1,315.88.

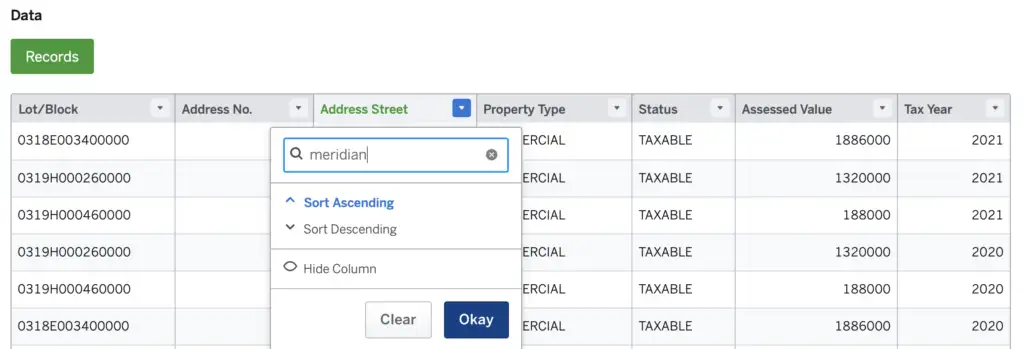

You can view your tax assessed property value on the OpenGov site for Mt. Lebanon. Scroll down to the area with data records and click the drop down arrow next to the ADDRESS STREET column. Enter your street name and click the blue OKAY button to filter the records to your street. Find your house number on the table and look across to the Assessed Value column for the assessed value of your property.

The municipality does not control the assessed value of your property. This is a function that happens at the county level on a periodic basis – typically every ten years. There are other situations which could trigger a reassessment, like property transfers, sales, etc.

Sections of the Mt Lebanon Budget

The Mt. Lebanon budget is divided up into sections that follow municipal departments and funds, which include:

- General Government

- Community Development

- Public Works

- Human Services

- Recreation

- Public Safety

- Capital Improvements

- Debt Service

- Special Revenue Funds

- Capital Projects Fund

Each section lists the revenue and expenses for that department, along with a line item service listing and explanation of what that department does.

Budget Discussion Sessions

The commission typically discusses the budget publicly throughout the month of November and holds the public hearing on the budget during the last meeting of November, and then votes on the budget in the first meeting in December.

Getting Involved In the Budget Process

As a resident, you have the ability to get involved in the budget process through the official public hearing where you can make public comment, and at any time by discussing your thoughts with your ward commissioner. It is helpful for commissioners to understand where the residents stand on any issue or budget line item. Discussing those things with your commissioner helps them fulfill their responsibilities as your elected official.

You can find your commissioner and contact them at the information listed on the Mt Lebanon Commission web page.

Responses